Analysis of Trade Competitiveness of Construction Machinery Manufacturing Industry in Germany

From January to August 2011, Germany's construction machinery manufacturing industry sales amounted to 8.12 billion euros, a cumulative increase of 26.3% over the same period of last year, and the growth momentum was higher than that of 2010. Among them, domestic sales amounted to 2.03 billion euros, which accounted for 25% of total sales. Foreign sales accounted for 1.66 billion euros for the euro area market, and 4.43 billion euros for sales outside the euro area, which accounted for the total sales. 20.4% and 54.6% of the amount. In the first eight months of 2011, the export ratio of German construction machinery changed little compared with the previous year, and the industry still relied more on overseas demand to drive growth.

In 2010, sales of construction machinery in Germany have rebounded significantly and the industry has shown signs of recovery. After March 2011, the year-on-year growth rate of German construction machinery manufacturing sales continued to decline. It is clear that the pace of its recovery is not yet robust. According to the incomplete statistical data of the European Union's statistics bureau in 2010, the output value of construction machinery in Germany accounted for the highest proportion in the 27 EU countries, which has the greatest impact on the development of the EU's overall construction machinery manufacturing industry.

In 2010, the total order value of construction machinery in Germany climbed month by month, reaching the highest value of 153 in November. The value of foreign orders was higher than the domestic order amount by 25 points on average. In the first eight months of 2011, the order total index remained at a relatively high level, and the order total index for the months of June and July was all around 170. The foreign orders index is higher than the domestic average of 34 points. Obviously, the order growth in 2011 is more due to the contribution of foreign orders.

Industry Cost Composition Analysis The German Bureau of Statistics also annually calculates the cost composition of the German construction machinery industry. In 2008 and 2009, the cost components of the German construction machinery industry accounted for the total output value of the industry for the year: raw materials 52.1% and 47.1%, respectively. Accessories 6.5% and 7.4%, staff salaries 14.9% and 20.0%, social welfare 2.6% and 3.6%, energy consumption 0.7% and 0.8%, depreciation 1.3% and 2.0% and other related expenses (including rent, interest, and other temporary expenses Etc.) 13.8% and 15.0%.

The development of the construction machinery industry in Germany has the following features: (1) On the one hand, more attention is paid to the saving of raw material costs. This part of the cost is precisely the largest part of the cost structure of the construction machinery industry. On the other hand, it pays more attention to improving the purchased parts. In proportion, these have played a positive role in reducing costs. (2) The proportion of personnel costs has increased more, and it has increased to around 1/4, which is obviously related to the characteristics of construction machinery as a technology-intensive industry. The industry pays more attention to the input of human capital in order to maintain the leading position in technology. , and then maintain a high market share. (3) The depreciation costs of construction machinery industry in Germany accounted for a slight increase, which may have a negative impact on the profit growth of the German construction machinery industry. The upward trend in energy consumption will cause the energy saving issues of the German government's energy management department to the industry. More attention.

According to the report of the 2011 Corporate R&D Investment Scoreboard issued by the European Commission, the rankings of R&D investment for construction machinery manufacturers in 2010 were as follows (a total of 1,000 listed companies were selected): US Caterpillar ranked 49th, R&D investment 1.42 billion euros, up 34.1% year-on-year, R&D investment accounted for 4.5% of net sales; US John Deere ranked 82nd, R&D investment was 784 million euros, up 7.7% year-on-year, accounting for 4.0%; Japan Komatsu ranked 145 The investment in R&D was 427 million euros, a year-on-year decrease of 13.6%, accounting for 3.2%; Liebherr Germany ranked 166th, with R&D spending of 363 million euros, a year-on-year increase of 26.9%, accounting for 4.8%.

Statistical Analysis of Imports and Exports 1: Exports According to the statistics of the German Bureau of Statistics, in 2010, German construction machinery exports totaled 8.122 billion Euros, an increase of 15.5% over the previous year. In the first eight months of 2011, the total export volume of construction machinery in Germany totaled 6.09 billion euros, a year-on-year increase of 29.1%. Among the top five are: Russia, China, the United States, France, and the Netherlands, which grew by 71.0%, 27.2%, 43.8%, 25.0%, and 35.7% respectively over the same period of last year. The growth rate of exports to Russia and the United States is much higher The level of 2010.

2: Imports In 2010, the total import of construction machinery in Germany was 2.930 billion Euros, an increase of 27.1% over the same period of last year. In the first eight months of 2011, German construction machinery imports totaled 2.46 billion Euros, a year-on-year increase of 48.2%, of which the top five were: France, Belgium, Italy, the United Kingdom, and Austria, which increased by 26.1% and 114.6 respectively over the same period of last year. %, 43.6%, 50.9% and 29.9%, especially the sharp increase in the rate of import growth in Belgium.

Analysis of trade competitiveness of main products of construction machinery The construction machinery manufacturing industry in Germany was divided into 17 sub-categories according to the industry classification of Eurostat. The import and export data of the German Bureau of Statistics in 2010 was analyzed. The export value of German construction machinery manufacturing was ranked. The top 5 products are: excavation machinery parts (including crane parts, the same below), other excavation machinery (including piling, snow removal, compactors, etc.), excavators, mining quarryers and sorters Parts. In 2010, Germany's construction machinery manufacturing exports grew faster than the previous year: tamping rollers (62%), bulldozers (49%), self-propelled front shovel loaders (38%). From January to August 2011, the export value of excavating machinery parts, excavators, and mining quarrying machines in Germany was 1.496 billion euros, 898 million euros, and 566 million euros, respectively, an increase of 18.7%, 49.1%, and 11.1% over the same period of the previous year. .

1: Excavator Product Trade Competitiveness Analysis Excavator is the main product of German construction machinery manufacturing industry, and it is also the most important core product of its external export. In 2010, the total amount of German excavator exports was 1.011 billion euros and the total amount of imports was 463 million euros. Calculated according to the trade competitiveness index (TC), the trade competitiveness index (TC) of the excavator industry in Germany was 0.372, indicating that its trade competitiveness is strong.

In the first eight months of 2011, Germany exported a total of 9,103 excavators, a year-on-year increase of 18.5%. The average unit price was 98,700 Euros per unit, a year-on-year increase of 25.8%. Obviously, German excavator manufacturers are more likely to win with quality and gain more marginal revenue. Although this may lose part of the market share, at the same time, due to the prominent characteristics of excellent product quality, it will lay a solid foundation for the long-term development of German excavators and consolidate its irreplaceable position in the international market. In the first eight months of 2011, the top five export markets were: the Netherlands, Australia, Russia, France, and the United States.

2: Excavating the trade characteristics of machinery components In 2010, the total amount of excavation machinery components exported from Germany was 1.93 billion Euros, the average export unit price was 5.96 kilowatts/ton, the total import amount was 1.32 billion Euros, and the average import unit price was 3.05 kilohms/ton. The TC index for the excavation of machinery parts industry in Germany was 0.189, indicating that its trade competitiveness is close to the international level, and the TC index is closer to zero, and the industry tends to trade within the industry.

In the first eight months of 2011, the top five markets for excavation machinery parts exports in Germany were: China, France, the United States, South Korea and Sweden, accounting for 9.9%, 8.9%, 8.5%, 7.3% and 5.7% respectively. The top five import markets were: Italy, Czech Republic, France, Poland, and Austria, which accounted for 15.2%, 10.9%, 8.0%, 7.4, and 5.6% respectively. China, South Korea, and the United States ranked 10th, 11th, and 11th respectively. Fourteen, accounting for between 4% and 3%.

From the perspective of intra-industry trade theory, vertical integration investment, especially trade with China, shows the distinctive characteristics of North-South trade, that is, exporting high value-added products to China earns high profits while importing low added value. Products or mature technology products to reduce overall machine production costs. In the first eight months of 2011, the average unit price of German excavation machinery and components exports to China was 11.5 thousand euros/ton, and the export value increased by 33.8%; the average import unit price was 1.3 thousand euros/ton, and the import amount increased by 48.3%.

In terms of trade with developed countries, the main source of imports for excavating machinery and components is the EU’s other strong manufacturing countries. The export market is not only in France, Sweden and other European Union’s engineering machinery manufacturing industry, but also includes the United States and South Korea. World-class engineering machinery manufacturing powerhouse, which fully reflects the characteristics of horizontal integration of intra-industry trade, that is, the developed countries trade through differential products to achieve complementary advantages and strong alliances. For example, in the first 8 months of 2011, the average unit price for excavation machinery imported from Italy was 3.1 thousand euros/ton, and the average unit price for export to the country was 2.7 thousand euros/ton; in 2010, the average unit price imported from the United States was 5.4. Thousands of euros/ton, exports of 5.6 thousand euros/ton.

The development of the construction machinery industry in Germany is closely related to other EU members. It gives full play to the intrinsic advantages of many established industrial powers, and is then integrated by German manufacturers relying on their own brand reputation and technological development and quality management advantages. The market competitiveness will inevitably be significantly improved. To a certain extent, the quality of German construction machinery is more a manifestation of the strength of the EU's overall construction machinery manufacturing industry.

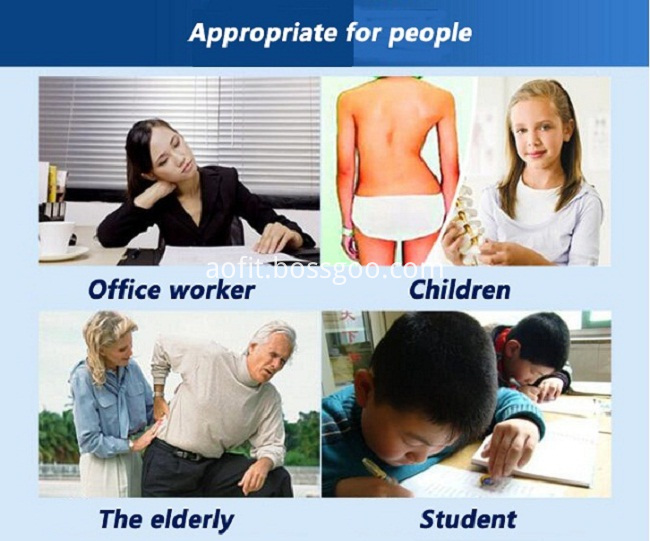

1. Posture corrector belts Help correct your posture, Make your waist and back stay straight

2. Posture corrector clavicle support brace belt Offers therapeutic, healing, drug-free pain relief for an achy back

3. Posture corrector adjustable belt Serves as an excellent aid for individuals with osteoporosis and Postural disturbances,

4. Posture corrector back support belts Relieve pain, Improve microcirculation, Reduce inflammation and swelling, Relax muscles and stop/prevent spasm

5. Back Braces Ease human body fatigued. Reducing lower back pain,slouching and hunching. Prevent deformation of spinal column.

6. Magnetic posture corrector belts Wear comfortable, tightness adjustable, protect the spinal cord, affinity of the skin, let the body enjoy more comfortable correct process every day

Posture Corrector,Back Posture Corrector,Corrector Posture,Posture Correction,Posture Brace,Back Posture

Shijiazhuang AoFeiTe Medical Devices Co., Ltd. , https://www.aofit.com